Whether you plan to take your family on a continental road trip in the coming months or work for a transport organisation that frequently enters the EU, the results of Brexit may alter your current travelling agenda.

In the event of a no-deal, several UK driving laws will change—for both UK citizens and commercial drivers. All drivers are being urged to contact their insurer to arrange a ‘Green Card’, which would be required under EU regulations as proof of insurance in the event of a no-deal. The Association of British Insurers is advising customers to contact their insurer for a green card about one month before they plan to drive their vehicle in the EU, or risk breaking the law. Don’t wait until it’s too late—use this guidance to ensure compliant driving practices post-Brexit.

Changes for UK Citizens

The government recently announced that—in the event of a no-deal—from 28th March 2019, UK citizens will need additional documentation to drive within the EU or EEA.

In terms of taking a holiday abroad, a no-deal will cause the type of international driving permit (IDP) that some countries accept to change. This means that UK citizens must possess both a UK driving licence and the correct IDP to drive in EU and EEA countries. For more guidance on finding the right IDP for your travels, click here.

If you are a UK driving licence holder that is currently living in the EU or EEA, it’s important to exchange your UK licence for a local EU licence before 29th March 2019. If you fail to do so, a no-deal may require you to pass a driving test within the EU country you reside in to continue driving there. You will be permitted to use your EU licence when visiting the UK, and you can exchange your EU licence for a UK licence (without taking another test) if you return to live in the UK. The government emphasises that you should exchange your licence as soon as possible to avoid longer processing times and delays.

Changes for Commercial Drivers

The government stated that commercial drivers will also need updated documentation to drive within the EU and EEA in the event of a no-deal. Although UK lorry drivers with international routes to and from the EU or EEA currently must have a standard international operator’s licence and a community licence, some countries may not recognise this documentation in a no-deal.

To prepare for this possibility, UK operators need to have an European Conference of Ministers of Transport (ECMT) international road haulage permit for international travel. The application period for ECMT permits closed on 18th January. If you applied for an ECMT permit, click here to find out what happens next. If you did not apply for an ECMT permit, consider investigating other options for transporting goods to the EU and EEA.

Lorry drivers should also consider exchanging their UK Driver Certificate of Professional Competence (CPC) for an EU Driver CPC, which they can do by applying to the relevant body in an EU or EEA country.

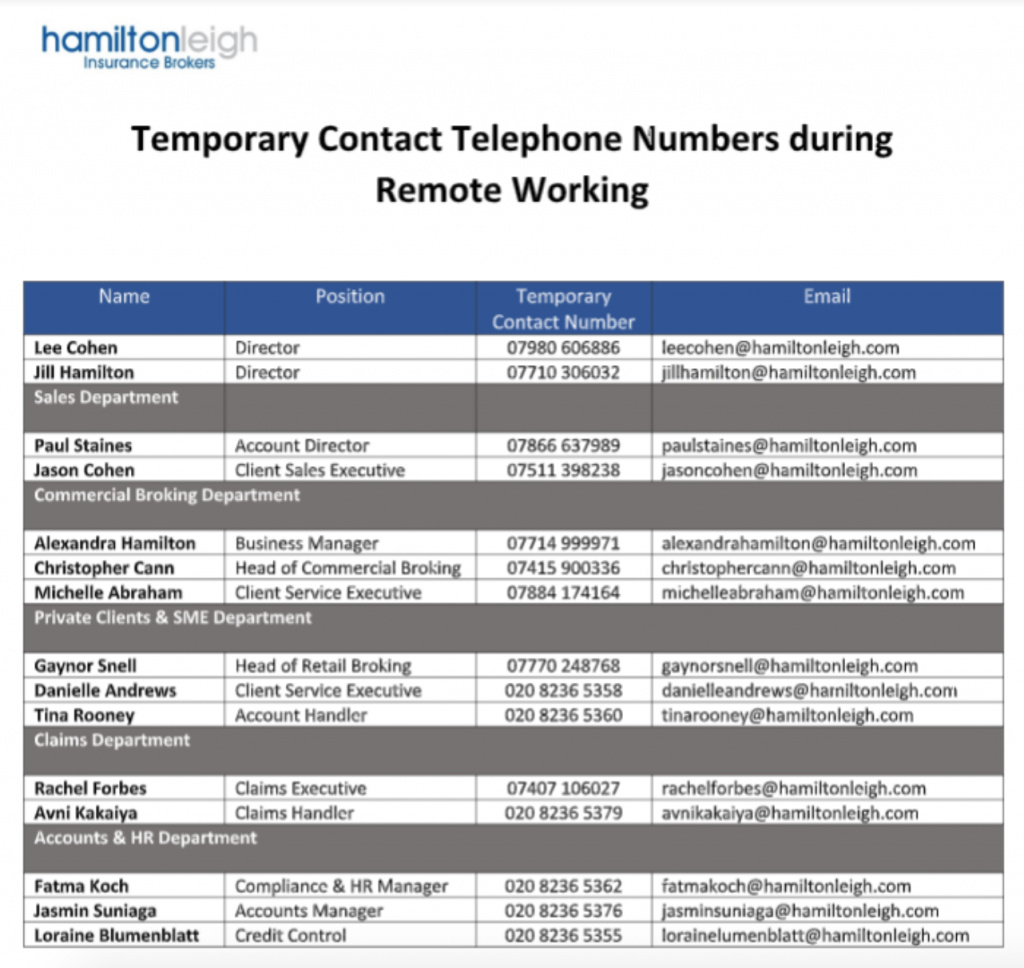

For insurance solutions to help weather uncertainty, contact Hamilton Leigh today.