FCA Business Interruption Insurance Test Case Appeal Supreme Court Ruling

January 26th, 2021 Posted by Hiten Joshi Uncategorised 0 comments on “FCA Business Interruption Insurance Test Case Appeal Supreme Court Ruling”The Supreme Court handed down judgment on the FCA Business Interruption Insurance test case appeal on Friday 15th January.

This largely agreed with the High Court ruling, in favour of the FCA and those policyholders with Non-Damage Business Interruption policy wordings.

The case was brought forward by the FCA to appeal certain issues on which it did not succeed in the High Court. Six insurance companies also appealed certain decisions made by the High Court and responded to the FCA’s appeal. The insurers were Arch, Argenta, Hiscox, MS Amlin, RSA and QBE; all of whom had their appeals dismissed.

The Test Case was designed to achieve clarity for policyholders, by seeking a binding court decision on the meaning and effect of the twenty-one sample policy wordings, provided by eight defendant insurance companies, albeit only six insurers appealed the High Court decision.

The sample wordings were chosen to be representative of those in the market that provide coverage for:

- Infectious and notifiable diseases (except where the policy contains a list of diseases or includes a limited number of notifiable disease).

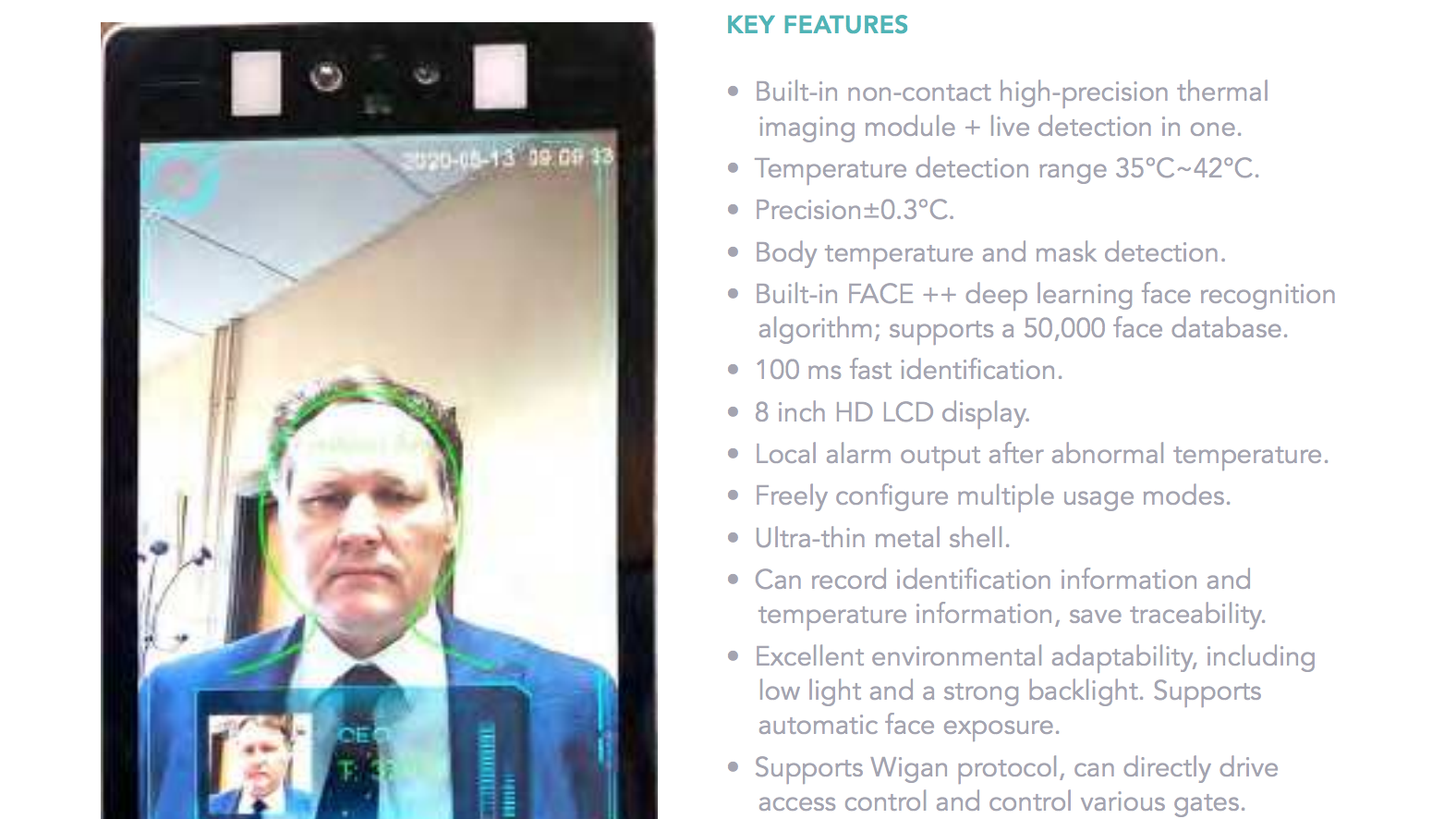

- Official actions or advice which affect a policyholder’s ability to access or use the insured premises.

The Supreme Court also considered the issue of causation and the basis on which successful claims might be quantified.

As previously explained, the vast majority of insurers were not party to the test case, nor are their policy wordings impacted by the Judgment. This is because physical damage to property is required by the majority of policies in order for there to be a valid Business Interruption claim or the list of diseases for which cover is provided is an exhaustive list and COVID-19 is not included.

The Judgment document consists of 114 pages, therefore, the FCA will publish a set of Q&As to assist brokers and their clients in understanding the test case ruling. The FCA will also publish a definitive list of Business Interruption policy types that potentially respond to the pandemic based on data that we will be gathering from insurers.

We welcome the clarity that the Judgment provides and we expect any issues not addressed by the Judgment will be assessed on a case-by-case basis as part of the normal insurance loss adjustment process. This should apply to all government restrictions, whether national or local, provided that a relevant policy was in force at the start of the relevant lockdown period.

Although the judgment establishes a number of points of principle on policy wording interpretation, the key point to keep in mind is that each policy and claim will need to be considered on its own merits, guided by points made in the judgment.

The Supreme Court’s judgment will be condensed into a set of declarations. The FCA and all defendant insurers are working as quickly as possible with the Supreme Court to enable the Court to issue these declarations.

While there may never be a way to completely make up for the financial losses that the pandemic wreaked upon businesses, the Supreme Court ruling is one of the most significant for business in modern times. The result should leave the insurance industry in no doubt that they should immediately start doing the right thing and settle valid claims.

We have studied the judgment in extreme detail and written to those clients with policies which we believe to be affected, albeit we are still awaiting the definitive list from insurers. Should you have any questions that you would like to discuss or require any additional support, please do not hesitate to contact your Hamilton Leigh Client Service Executive.

Please click on the link for the Supreme Court judgment here.

A summary of the ruling from Herbert Smith Freehills can also be found by clicking on the link here.