Update: Our Business Operations

June 23rd, 2020 Posted by Hiten Joshi Uncategorised 0 comments on “Update: Our Business Operations”We regularly review our remote working business plan to ensure we continue to operate effectively throughout this pandemic. Every member of our broking and claims team has worked tirelessly to ensure our service proposition during lockdown remained seamless and we shall continue to work remotely following advice and official guidelines from The Government. We are planning the return to our office premises as and when The Government guidance allows us to do so and currently carrying out specific Covid-19 risk assessments and taking all necessary steps to ensure the safe return of our team.

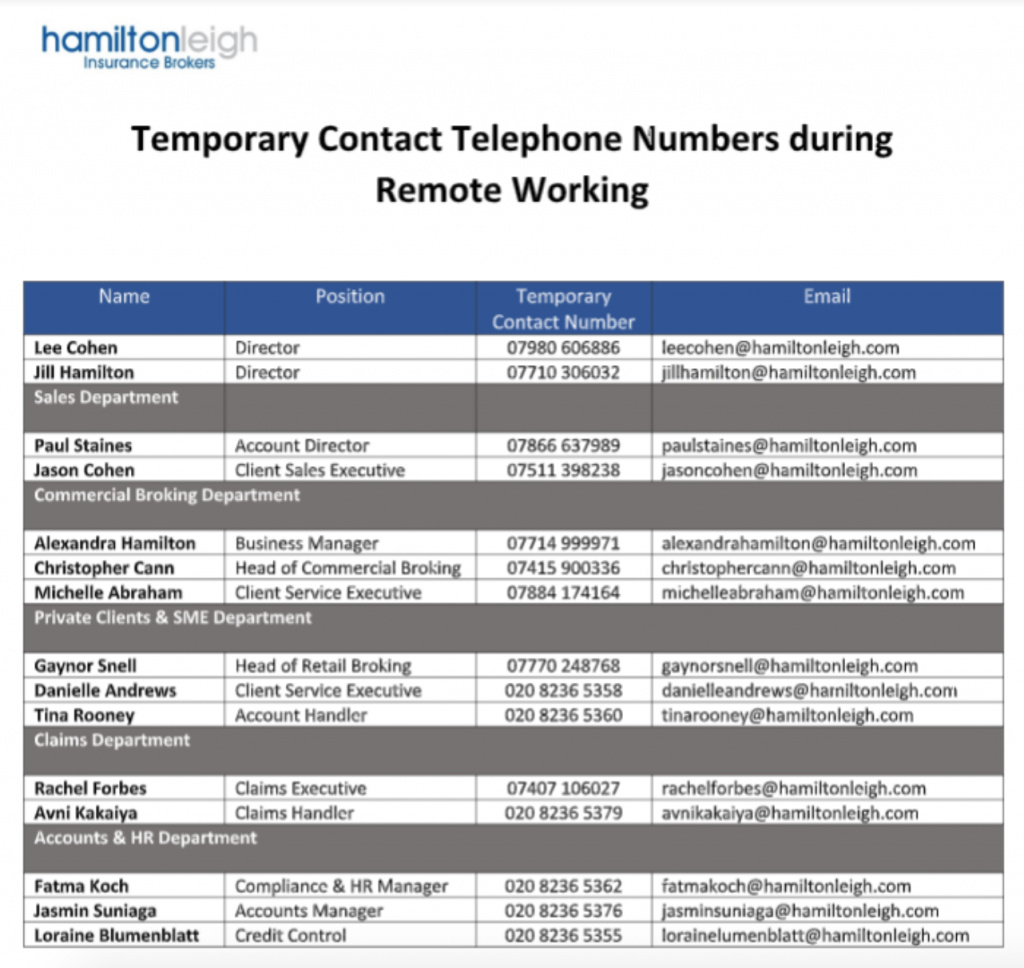

Like all businesses, we are working on a practical framework to consider new ways of operating, complimenting and improving the service proposition we provide to our clients. In the meantime, contact numbers and email addresses remain unchanged, so you don’t have to do anything differently to get in touch. Some phones however may be diverted to mobiles. We continue to facilitate client and new customer meetings using Zoom video conferencing and to ease the strain on our remote telephony capability we ask that you communicate with us by email, wherever possible. Your business is and will always continue to remain our focus.

Please follow us on our LinkedIn: Hamilton Leigh Ltd or on Twitter @HamiltonLeigh which is where we’ll flag relevant updates rather than sending multiple emails. The webpage we will be updating regularly is as follows: www.hamiltonleigh.com