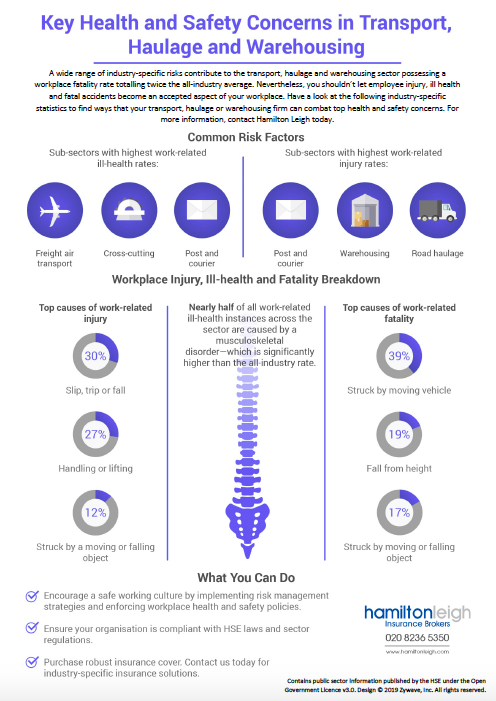

Here are the key reasons why this will be the hardest insurance market in a generation:

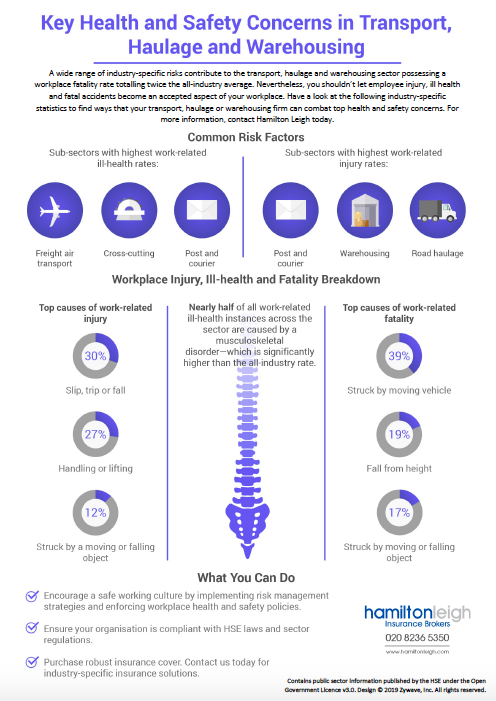

For the past 16 years, UK businesses have benefited from the longest period of ‘Soft Market’ conditions on record; this side of the market cycle is characterised by low rates, high limits, flexible contracts, and high availability of coverage.

Soft market characteristics

In soft market conditions, insurance companies often try to expand their market share. They enter growth mode, offering cheap rates, attractive policy terms, and, when allowed, discounted coverage. In the most extreme cases, the soft market resembles a bidding war, to offer the cheapest deals. Brokers should have proactively shopped around for their clients but as more businesses moved to new insurance companies offering lower rates, profits for the entire industry began to reduce. On top of that, when focusing on growth, market share and share price, insurers relaxed their previously stringent underwriting attitude, resulting in rising loss ratios. A correction to this unsustainable situation (reduced profits and rising loss ratios) was necessary, forcing the insurance market to harden.

What is a ‘Hard Market’?

In the insurance industry, a hard market is the upswing in a market cycle, when premiums increase and capacity for most types of insurance decreases. This can be caused by a number of factors, including falling investment returns for insurers due to low interest rates, increases in frequency or severity of losses, EU & regulatory intervention deemed to be against the interests of insurers and increased reinsurance costs.

Hard market characteristics

In a hard market, there’s less desire for growth and more of a restriction in the marketplace as insurance companies re-evaluate their books of business, their risk appetites, and how much capacity they want to present in the marketplace. In hard market conditions, underwriters often adhere to stricter standards in an attempt to correct any adverse loss ratios developed during soft market conditions. As a result, insurance rates often go up, the indemnity limits insurers are willing to provide decreases, and the number of players in the market reduce. This makes it harder for brokers to find coverage options, which means the insurers that are offering coverage can increase their rates.

Several factors have caused this rapid hard market?

- launched in 2016, Solvency II which applies across the whole of the EU, placed a requirement on UK insurers’ to more than double their spare capital requirements. This has led to a number of insurers leave the market whilst others have significantly reduced their underwriting appetite and capacity

- The Ogden discount rate is a calculation used to determine how much money insurance companies should pay as compensation to people who have suffered life-changing injuries so that it will cover all their predicted future losses. When the Minister of Justice changed the Ogden table rate in December 2016, it meant that insurers had to pay out far more on larger personal injury claims. This figure shocked the insurance world, as reserves on catastrophic injury cases had the potential to double or worse.

- The insurance industry has endured persistent high loss ratios since 2013, primarily caused by an increase in frequency of severe property losses. Property rates in the UK were already far too low as we entered 2020 (affecting most commercial insurance policies). Soft market rating had become completely uneconomic. Even if we ignore the terrible recent events, insurers needed property rates to increase considerably in 2020

- With property accounts already losing money, the last thing UK insurers needed were floods caused by storms Dennis and Ciara, estimated to cost well over £400 million. Climate change is causing insurers to struggle with correctly predicting floods, and they need to build up a pot of money to take care of the next set of bad floods which will inevitably be on their way

- Reinsurance is a key component of an insurers pricing model and rates will rise significantly leaving insurers with no option other than to reflect these increases in their rates and to reduce their market capacity

- When interest rates are high, insurers can get away with a certain amount of underwriting losses as they generate substantial investment income. Unfortunately, this is no longer the case, as the current interest rates are the lowest in the Bank of England near 300-year history. Insurers therefore have no option but to increase rates to balance their books

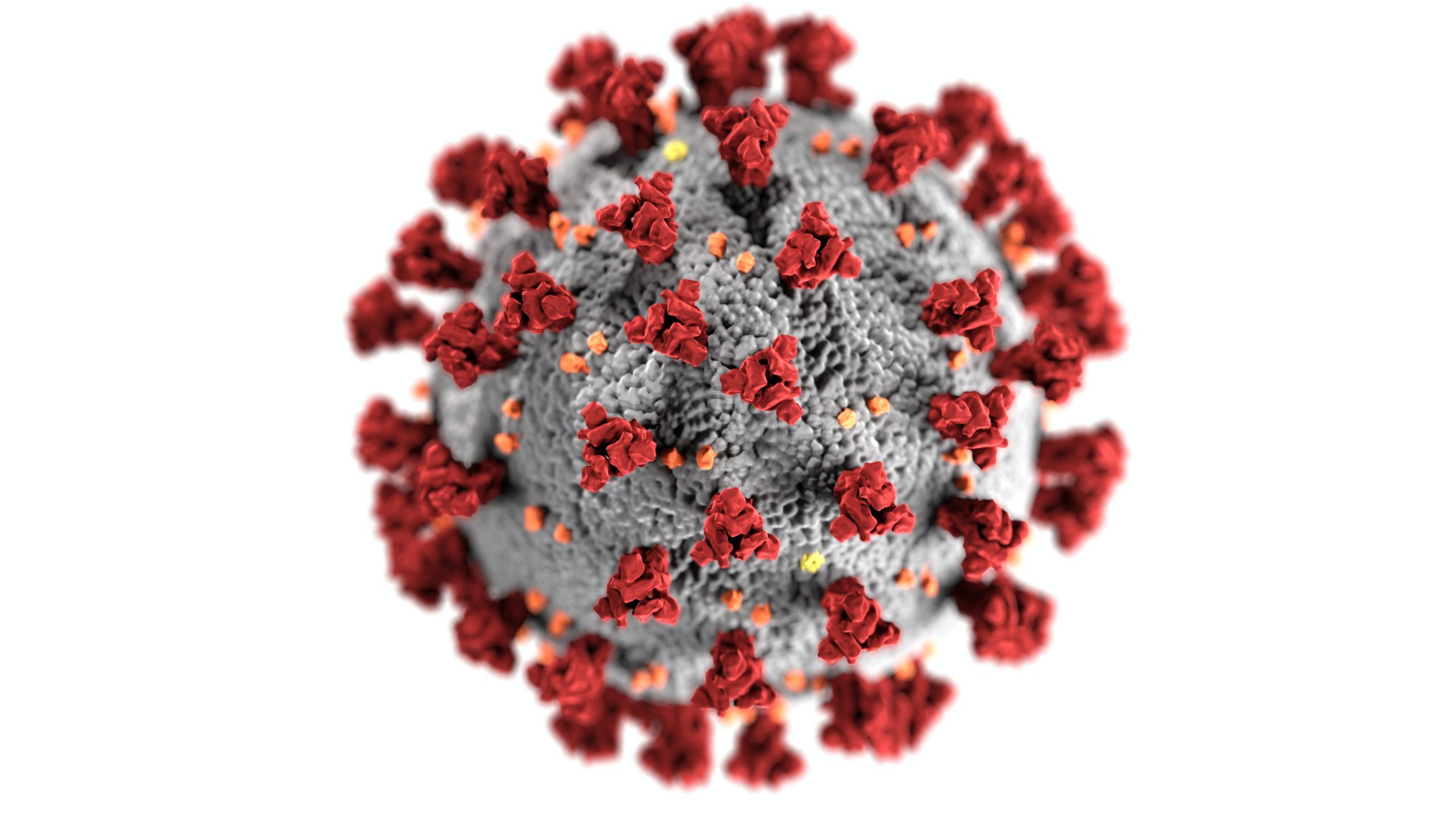

- Finally, it is estimated that the combination of Covid-19 insurance claims, reduction in business and investment losses will cost the worldwide industry in excess of £200 billion, making it the most expensive insurance event ever. Clearly the current FCA test cases will have a significant bearing on how much the UK insurance industry will have to pay out in Business Interruption losses relating to Covid-19 but this is unlikely to be determined for several months

Holistic View

This leaves us in the midst of rising insurance rates at a time when business risks are seemingly more prevalent than ever. Cyber breaches, climate change, pandemic, trade and professional risks are at the top of mind for most business owners.

Now is prime time for business leaders to take a thoughtful step back and reassess how they view and manage risk within their organisation. Insurers are in the business of risk but given the rapid hardening of premium and terms, businesses with a strong risk management perspective and a track record of low claim activity can avoid the sweeping increases of premiums and terms, likely to affect the majority of UK businesses.

Taking a holistic view of risk can help identify ways to treat risk beyond just buying insurance. Analytical tools and a focus on total cost of risk can help businesses take a broader approach to managing and financing their overall business risks. Higher excess and/or deductibles are also ways to mitigate the continuing rate increases in the insurance market.

How Can Hamilton Leigh help you?

- Design and introduce a comprehensive and robust risk management programme

- Ensure your risk management strategy, systems & controls are communicated throughout the business to create a strategy of collective responsibility

- Communicate your risk management strategy with your insurers to demonstrate your proactivity

- Agree a risk retention strategy that accurately reflects the business’s risk tolerance appetite

- Investigate alternative risk retention options such as higher excesses and/or deductibles

- Reassess loss prevention practices

- Introduce you to your insurer to develop a strong, supporting business relationship

For further information, please contact Lee Cohen: M: 07980 606886 E: leecohen@hamiltonleigh.com